The Coronavirus (COVID-19) pandemic has transformed work and life, creating new challenges for employees and employers. Understanding how to improve employee wellbeing is key to helping employees navigate this new reality.

Following on from two waves of research exploring the impacts of COVID-19 in March and May, this year’s Employee Benefits Trends Study explores how employees are managing work-life stress in the wake of the pandemic and how a holistic approach to wellbeing, supported by the right programs and benefits, can promote a more engaged, productive and successful workforce.

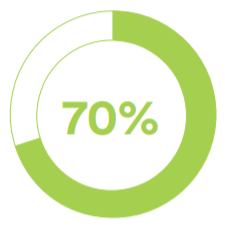

The research shows that Australian’s overall health and wellbeing has fallen in recent months. Those feeling the impact most include younger cohorts, essential workers, and the unemployed. But it has been shown in our study that holistic health and wellbeing is generally better among those who’s employer responded positively to COVID-19 and provided genuine support during this difficult time.

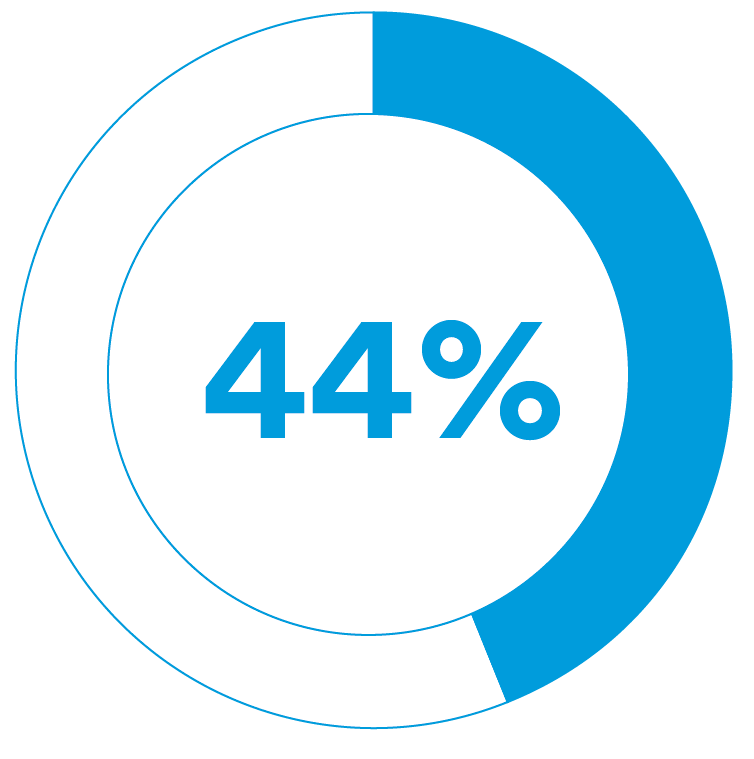

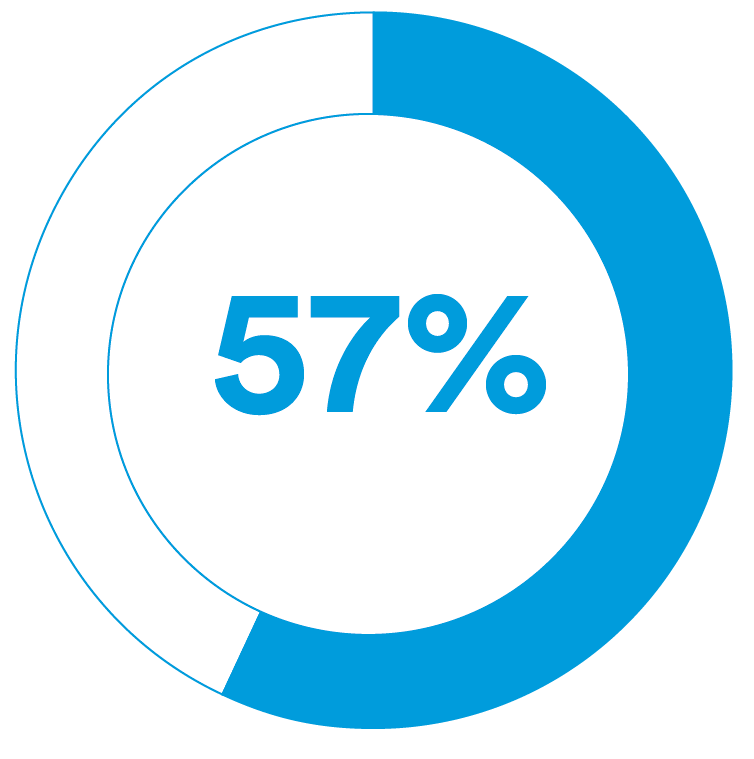

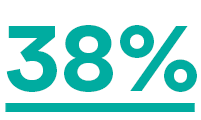

The key findings from the research helps us provide insights and actions employers can take to ensure their employees feel supported, are engaged, and manage stress levels. The study highlights that while employers are prioritising the mental aspect of their employee wellbeing, right now, financial health is the top concern for employees, and plays an especially important role in their overall wellbeing, and mental health in particular.