With the Protecting Your Super legislation 1 July deadline fast approaching, the time has come for superannuation trustees and life insurers to come together to implement the changes successfully.

We know that each of our clients has a unique membership base, a different approach to marketing and communications, and resources and budgets that span the spectrum, so success can look different from one to the other.

However, there can be common themes. So, what are the key components for a successful implementation?

Success comes in phases

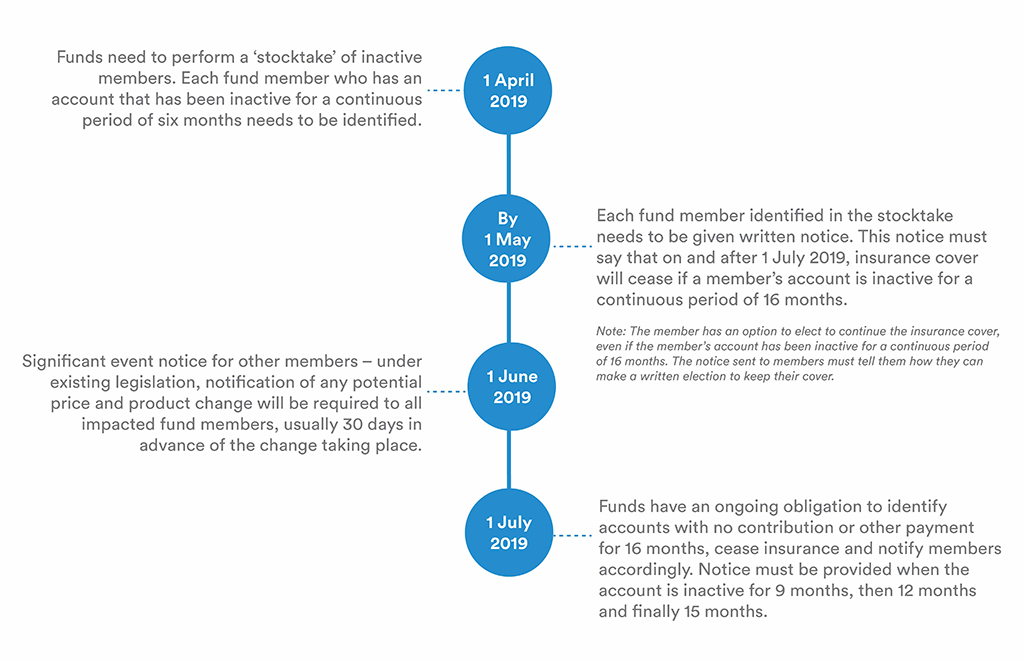

The changes required by the legislation are complex and actions can be broken down based on timings:

2019

1 May

2019

Note: The member has an option to elect to continue the insurance cover, even if the member's account has been inactive for a continuous period of 16 months. The notice sent to members must tell them how they can make a written election to keep their cover.

2019

2019

Since preparing this blog, the Government finalised the Protecting Your Super Regulations on 5 April 2019. The Regulations provide that inactivity notices must be provided if the account has been inactive as at 7 months prior to insurance cessation, then 4 months prior to insurance cessation, and finally 1 month prior to insurance cessation. Notices must be given within 2 weeks of each relevant date. If the cessation period is 16 months, notices must still be provided if the account is inactive for 9 months, then 12 months, and then 15 months. The Regulations recognise that product rules may specify a shorter cessation period than 16 months and that the timeframe for providing notices should be adjusted accordingly.

Any additional communication that can be done in and around these key events will help build the story for members and a multi-channel approach will help drive this.

Success comes with awareness

Our Insurance Inside Super research1 revealed interesting statistics about member awareness and engagement with both their superannuation and insurance. For example:

- 74% are aware they can get insurance through super, however only 54% claim to have it;

- 2 in 3 don't know how to calculate how much life insurance cover they need;

- 1 in 3 of those who have insurance, don’t know the amount of cover they have;

- 4 in 10 aren’t aware they can modify their insurance;

- 59% have concerns with insurance companies paying out in the event of a claim, although we know that over 90% of claims are paid.

These statistics show that we have hurdles to overcome regarding the knowledge and understanding of the cover that members hold.

Success comes with context

Our behavioural science-led research into the optimal engagement strategy to adopt when communicating changes was quite clear that effective communication around insurance would ideally be designed as a gradual story being told. A communication, without context or build up, could yield unintended consequences around an increase in complaints and member dissatisfaction.

So, while the industry must communicate with its members to comply with legislative changes, we can’t assume that members who are impacted understand that they have cover, that they are paying for it, or value it.

Ideally super funds should start communication with members as soon as possible and consider using various channels to start telling the story. This will help ensure that when members are given the choice, they are better prepared for the change.

For many super funds this could be using existing channels such as social media, regular e-newsletters, or through employers as a starting point. Given the short time-frames, it won’t be perfect but it will help with the overall effectiveness.

If you’d like to understand more about the Insurance Inside Super or Behavioural Science research, and how MetLife can support your teams to implement the changes, please reach out to your MetLife Relationship Manager.

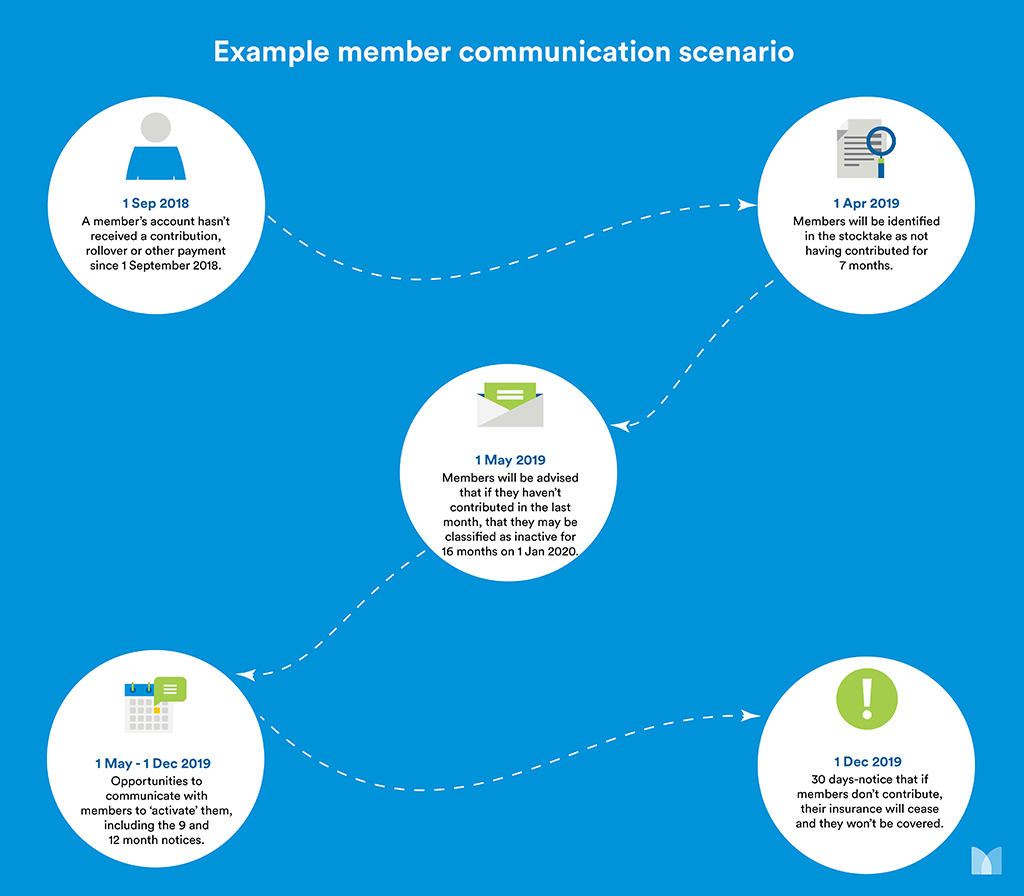

1 Sep 2018

1 Sep 2018A member's account hasn't received a contribution, rollover or other payment since 1 September 2018.

1 Apr 2019

1 Apr 2019Members will be identified in the stocktake as not having contributed for 7 months.

1 May 2019

1 May 2019Members will be advised that if they haven't contributed in the last month, that they may be classified as inactive for 16 months on 1 Jan 2020.

1 May - 1 Dec 2019

1 May - 1 Dec 2019Opportunities to communicate with members to 'activate' them, including the 9 and 12 month notices.

1 Dec 2019

1 Dec 201930 days-notice that if members don't contribute, their insurance will cease and they won't be covered.

Tags:

- MetLife Australia,

- MetLife Blog,

- Australian Life Insurance,

- Australian Superannuation,

- Australian Super,

- Life Insurance and Superannuation,

- Life Insurance,

- Life Insurance in Superannuation,

- Life Insurance in Super,

- MetLife Australia Life Insurance,

- MetLife Life Insurance ,

- Superannuation,

- Superannuation Partners