Achieving Real and Sustainable Change for a Confident Future: How MetLife is Tackling Sustainability

04-10-2023 In this era of heightened awareness about environmental and social challenges, companies are expected to be responsible stewards of the planet and its people as they work to deliver financial results. READ MOREKnow what's in your heart

26-09-2023 Heart disease is a very broad term for many conditions that can affect your heart. While some elements of heart disease are beyond our control, in this article we’re focusing on heart issues that can be prevented or controlled. READ MORETele-PMARs: Rapid access to medical information to make informed decisions, faster

18-09-2023 Simon Dent, National Underwriting Distribution Manager, discusses MetLife’s latest underwriting service – tele-PMARs via Tele Report Retrieval – and how it enables faster access to medical information. READ MORE4 Ways to Beat Stress

30-08-2023 With a long to-do list, plus family and work commitments competing for your attention, it’s no wonder you sometimes feel stressed. Here’s 4 ways from the 360Health team you can start taking action to beat stress right now. READ MOREMeet Julio Cagigas

20-07-2023 Meet Julio Cagigas – an avid cook, keen boatsman, father of three young girls and now, the new Head of Retail Distribution at MetLife Australia. READ MORESuperannuation Measures for Life Insurers and Corporate Partners

29-05-2023 The Australian Government has announced several measures related to superannuation that impact life insurers and corporate partners. READ MOREMeet Dr Jeffrey Scott

18-05-2023 With over 25 years’ industry experience and most notably credited for creating the first terminal illness benefit for life insurance products in Australia, it’s fair to say that Dr Jeffrey Scott is a powerhouse of knowledge when it comes to all things life insurance. READ MOREMetLife Protect and MetLife Protect Super Income Cover: Rehabilitation Expenses now paid separately

04-05-2023 At MetLife, we believe that Income Cover is more than merely paying a monthly benefit to replace lost salary or wages, it’s also about providing your clients with the support they need so they can return to health, wellness, and work. READ MOREThe Objective of Superannuation

13-04-2023 Australia recently passed a very significant milestone - 30 years of compulsory superannuation. Yet, despite its existence for all this time, it might surprise many that there has never been a legislated objective of superannuation. READ MORESnapshot of the Retail Life Insurance Industry

13-04-2023 Dr Jeffrey Scott provides a snapshot of the Retail Life Insurance Industry as at April 2023. READ MOREMeet Dianna Goss

10-03-2023 Dianna Goss believes that financial equity for women is important and that financial advisers can play a crucial role in helping women to be financially literate. READ MOREMeet Andrew Bridgland

23-02-2023 With over 40 years in the industry Andrew Bridgland has seen many changes but one critical factor remains: life insurance products can provide much needed security to Australian families, individuals, and businesses. READ MOREThe recipe for healthy living: combining good nutrition with mindfulness

07-02-2023 Dietitian and mindfulness expert Dr Tasmiah Masih (Tas) believes we would all derive enormous health benefits by integrating stress management into our everyday activities – particularly when it comes to our food choices and how we prepare meals. READ MOREHealthy Habits - How to move

07-02-2023 Our MetLife 360Health "Habits How-To" series features tips, tricks, and activities to help you establish healthy habits and maintain them in the long run. Find out the benefits of moving and how to make it a habit. READ MORENew Year's Resolutions

12-12-2022 These tips from the MetLife 360Health team can help you come up with New Year resolution ideas, make realistic goals, and stick to them for the year ahead. READ MOREEnd of year tips

02-12-2022 As the year comes to a close, the 360Health team shares some tips from Money by Design on how to reflect on the year that was and plan for the year ahead. READ MORETop tips for the festive season

25-11-2022 The festive season can be a wonderful time to recharge from the work year, celebrate with friends and family, and prepare for the year ahead. But for many Australians, it can also be a time that is met with increased levels of stress, anxiety and loneliness. READ MOREUnexpected Signs of Work Burnout

21-11-2022 As we get to the end of the year mental health is top of mind for many of us, workplace burnout might be taking on forms that are harder to identify than usual. READ MORELooking for timely mental health support – your employer might be able to help

26-10-2022 If you have tried to seek mental health support over the past two years, you might have found it hard to get the right advice and guidance and you’re not alone. READ MOREBack in the saddle

19-10-2022 In his role as head of insurance at Hostplus, Shane Fielding understands the value of insurance but it wasn’t until he sustained serious injuries in a bicycle accident that he realised just how valuable his MetLife Income Protection cover could be. READ MOREThe mental health benefits of routine

21-09-2022 MetLife’s Chief Medical Officer, Dr Samuel Lim, explains the stress signs to look out for, how to bring positive mental health activities into your life, and where to get help if you’re feeling overwhelmed. READ MOREMetLife experts bring diverse views to CMSF

19-09-2022 At the most recent CMSF Conference in Brisbane, MetLife was delighted to participate in three often lively panel discussions around key topics related to the industry. READ MOREThe strong beat of your heart

09-09-2022 Your heart is a muscle, and there are so many things you can do to make that muscle stronger. You may not realise how some bad habits can harm your heart over time—and how some good habits can help your heart perform like a champion. READ MOREIf your heart needs extra support

09-09-2022 If you’ve already made lifestyle changes to keep your heart strong, your doctor will certainly encourage you to keep up the good work. But sometimes lifestyle changes alone can’t control or correct heart issues. READ MORECommon myths about skin cancer

07-07-2022 There are so many myths and misconceptions about skin cancer, it’s hard to know where to begin! READ MOREExperimentation at MetLife

15-06-2022 At MetLife we recognise that experimentation is our pathway to continually improving our business and the experience of our customers. READ MOREMore than a bad day - Symptoms and types of depression

06-06-2022 Does feeling less energetic or wanting to sleep and sometimes eat more sound familiar? But what does it mean if you’ve been feeling this way for a long time? Have you ever wondered if you might be depressed? READ MOREDEI Month of March

01-03-2022 At MetLife, we believe the key to a positive working environment is creating a collaborative community with diverse perspectives and a united vision. Throughout the month of March we are focussing on DEI at MetLife, with our Committee hosting events to help educate and increase awareness of diversity issues. READ MOREChanging life stages and how they're driving interest in life insurance

18-01-2022 A desire to provide a reasonable quality of life for loved ones has always been a logical motivator for investing in life insurance. Now more Australians are reviewing their priorities and paying increased attention to how much cover they have at each life stage. READ MOREGrit, family love and an unlikely feathered friend helped Sam Bloom recover

17-12-2021 A devastating accident left Sam Bloom paralysed from the chest down. But the love of her family, an iron will and a little help from a baby bird helped her bounce back and find meaning in life. READ MORETriumph over adversity: the story of Paralympics champion Curtis McGrath

17-12-2021 Paralympian, Australian Army vet and double amputee Curtis McGrath reflects on his experiences and how he learned that having goals and overcoming adversity are the most important things in life. READ MOREWhy life insurance is also good for your financial wellness

20-09-2021 MetLife’s latest Employee Benefit Trends Study reveals most people want long-term financial security, but they say it’s harder to stay on track with goals during these times. READ MOREDark Side of the Screen

13-09-2021 The MetLife 360Health team explores how screen time can impact our sleep. READ MORESelf Care Top Tips

13-09-2021 It is important that during stressful times you carve out some time for yourselves. Here are some tips from MetLife 360Health. READ MORENutrition tips

10-09-2021 We all know that diet care and healthy eating are essential to keeping our immune system functioning optimally, yet we don’t prioritise it when dealing with stress and isolation. READ MOREHealthy Habits - How to thrive

31-08-2021 Mental wellness is a process that we engage in proactively – it is not a static state of being – eMindful. These tips and strategies from the 360Health team can help you boost your mental health. READ MOREHealthy Habits - How to sleep

31-08-2021 When our sleep is poor, or we cannot get enough sleep, we may not function normally during the day when awake. When it comes to mental health, good sleep, a healthy diet and exercise are all critically important. READ MOREHealthy Habits - Primer on Habit Formation

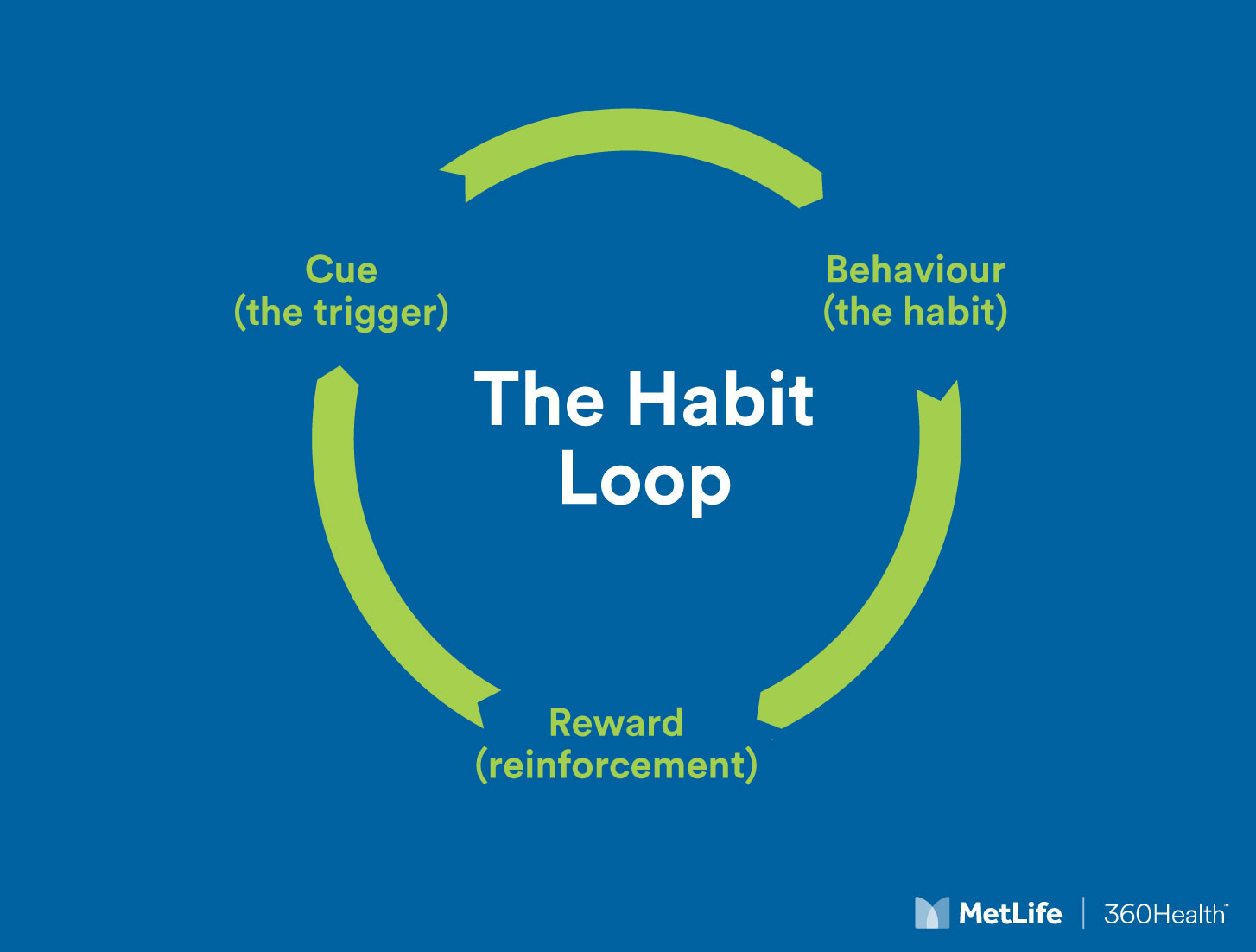

30-08-2021 Our MetLife 360Health "Habits How-To" series features tips, tricks, and activities to help you establish healthy habits and maintain them in the long run. If you’re interested in establishing healthy habits, it’s helpful to understand a few basic concepts: The Habit Loop and Motivation READ MOREInsurance Inside Super – Top Questions

10-08-2021 Your top questions answered about Insurance Inside Super. READ MOREInsurance through super– how it works, what you need to know

03-08-2021 Most of us think of our funds as a way to save for retirement. But they can also be a source of low-cost cover. READ MORE5 Things You Should Know About Life Insurance

26-07-2021 Life insurance can be your safety net when things go wrong. Here are some lesser known things about life insurance to help you make an informed choice. READ MOREInsurance Inside Super: Important Things to Know

26-07-2021 Most superannuation funds offer a built-in life insurance policy – also known as Insurance Inside Super (IIS) – to their members. Learn about its inclusions & benefits. READ MOREWhy Life Insurance Cover Needs to Change as You Grow

26-07-2021 Changing circumstances, rises or falls in income and whether or not the kids are still at home all affect the amount of coverage you need. Learn more READ MOREValue of Life Insurance - helping superfunds educate their members

20-07-2021 It is more important than ever that we educate super fund members about the value of default insurance within their fund, so that they can make informed decisions about their cover. READ MORECommunicating the value of life insurance to everyday Australians

19-07-2021 Communicating the value of life insurance to everyday Australians is important, but it’s not always easy. That’s why MetLife has released the Value of Life Insurance Report. READ MOREWhat is life insurance?

08-04-2021 We explore everything you need to know about life insurance – and making the right choices so you and your loved ones are protected. READ MOREEmbedding an ethical culture in a new world

24-03-2021 How can we embed an ethical culture in this changing world? Pauline Vamos, Director of the Banking and Finance Oath shares the why and ways to embed ethics into your business. READ MOREGroup insurance: Where to from here?

17-03-2021 Wendy Tse, Chief of Staff and External Affairs at MetLife, shares key insights into the challenges and opportunities ahead for group insurance following her presentation at the ASFA Virtual Conference in February 2021. READ MORE5 tips for the FASEA exam

14-01-2021 Stressed about the FASEA exam? Don’t be. Dr Jeffrey Scott, MetLife’s Head of Advice Strategy, has five tips to help you perform your best. READ MOREWhy MetLife's underwriting process works better

04-01-2021 We have invested in our underwriting process to make it stand out from the competition. Find out how our communication and customer service-centric approach to underwriting can make life easier for advisers. READ MORECOVID-19: The industry challenges that lie ahead

19-11-2020 Dean Mulheron, Head of Group Product shares some of the key challenges and opportunities that face the industry. READ MOREHow much life insurance do I need?

28-10-2020 Life insurance is designed to give you peace of mind – ensuring your loved ones can cope financially if something happens to you. Here are tips for working out the right amount of life insurance to provide certainty for your family. READ MOREIs income insurance worth it right now?

28-10-2020 You insure your home and contents as well as your car, but how much do you think about insurance that protects your income? Find out if income protection is right for you. READ MOREWhen should I review my life insurance cover?

14-10-2020 When was the last time you checked on your life insurance and insurance inside super? Does your existing cover meet your current needs? It might be time for a review. READ MOREHow MetLife Australia is looking after its people during the pandemic

03-09-2020 Understanding the new normal: MetLife Australia's CEO Richard Nunn explains the company's proactive approach to looking after its people, customers and partners during COVID-19. READ MORETPD insurance inside and outside superannuation – Let’s talk tax and net benefits

18-06-2020 Advisers are often asked whether or not a client should own their TPD policy individually (self-owned) or have it be structured via a superannuation fund where they are a member. READ MOREBuilding your business

20-04-2020 Millennial financial wellness adviser Rebecca Maher offers some clear and practical strategies to help you support your clients during these economically uncertain times, and potentially grow your business too. READ MOREWhy MetLife?

14-04-2020 An easy reference guide that explains who MetLife is, our unique product features, and why we’re a global leader in insurance that supports advisers to offer the best advice. READ MOREHow MetLife is making Life and TPD more accessible for over 45s

14-04-2020 Half of Australians over the age of 45 are financially unprepared. But they’re also facing modern challenges of higher mortgage debt, boomerang kids, and later retirement. READ MORELife Insurance Explained in 60 Seconds

31-03-2020 If you’re under 25, you’re bulletproof and don’t need life insurance, right? Unfortunately not. Find out in less than a minute why you need financial protection even when you’re young. READ MORE10 tips for advisers

03-02-2020 Metlife’s experts share their insider tips on keeping existing clients, attracting new ones and growing your business in times of industry change. READ MOREThe retail claims process

28-11-2019 When it comes to making a claim, MetLife’s Peter Kelly says it’s vital your clients know you’ll be helping them with the hard work so they can focus on other things. READ MOREWhy advisers need to strengthen connections with their clients

24-09-2019 Our research reveals financial advisers risk losing clients if they fail to demonstrate long term value of advice. READ MOREEffective PMIF implementation starts with listening

05-09-2019 Recently MetLife held a successful member engagement workshop on communicating PMIF changes to members. Senior Manager Member Engagement, Brian Jacobs, shares with us some insights from the workshop. READ MORETop 5 questions about Insurance Inside Superannuation

03-09-2019 We asked financial adviser Glen Hare about the most burning questions his clients ask about insurance inside superannuation (IIS) and what he tells them about making the right insurance decisions. READ MORETips to communicate PYS legislation successfully

08-04-2019 With the Protecting Your Super legislation 1 July deadline fast approaching, the time has come for superannuation trustees and life insurers to come together to implement the changes successfully. READ MOREAn agile approach

05-03-2019 MetLife’s agile approach is seeing products rapidly evolve in line with client and adviser needs. Janhvi Chadha, Product Manager for MetLife Australia’s Differentiate Program, explains how the new approach works and why it has been implemented. READ MOREWhy modular MetLife Protect makes sense

17-10-2018 MetLife recognises that everyone is unique, so their insurance needs to be too. Meet the new modular cover you can tailor to match what truly matters for your client. READ MORESurvey says: 7 lessons for financial advisers

09-10-2018 Nothing succeeds like heeding client feedback. Our major survey of the financial advice sector reveals just what clients are looking for. READ MOREHow Much Life Insurance Do you Need?

27-07-2018 We never know what’s around the next corner. But with life insurance, you can help make sure that whatever happens, your loved ones are financially protected. READ MOREWhat is underwriting anyway?

05-02-2018 Underwriting simply means assessing risk. Find out more about what life insurance underwriters look for – and how this can affect your life insurance application and premiums. READ MORE10 tips to get started with Life Insurance

23-01-2018 Many people know they need life insurance, but they don’t take the next step because they’re not sure where to start. Here’s what you need to know. READ MORE