Supporting holistic workforce wellbeing

15-02-2021 With the lines between work and home life increasingly blurred, and stress mounting due to the global pandemic and its related economic consequences, many Australians are struggling with their health and wellbeing. READ MOREEmployees expectations of flexible working arrangements is changing

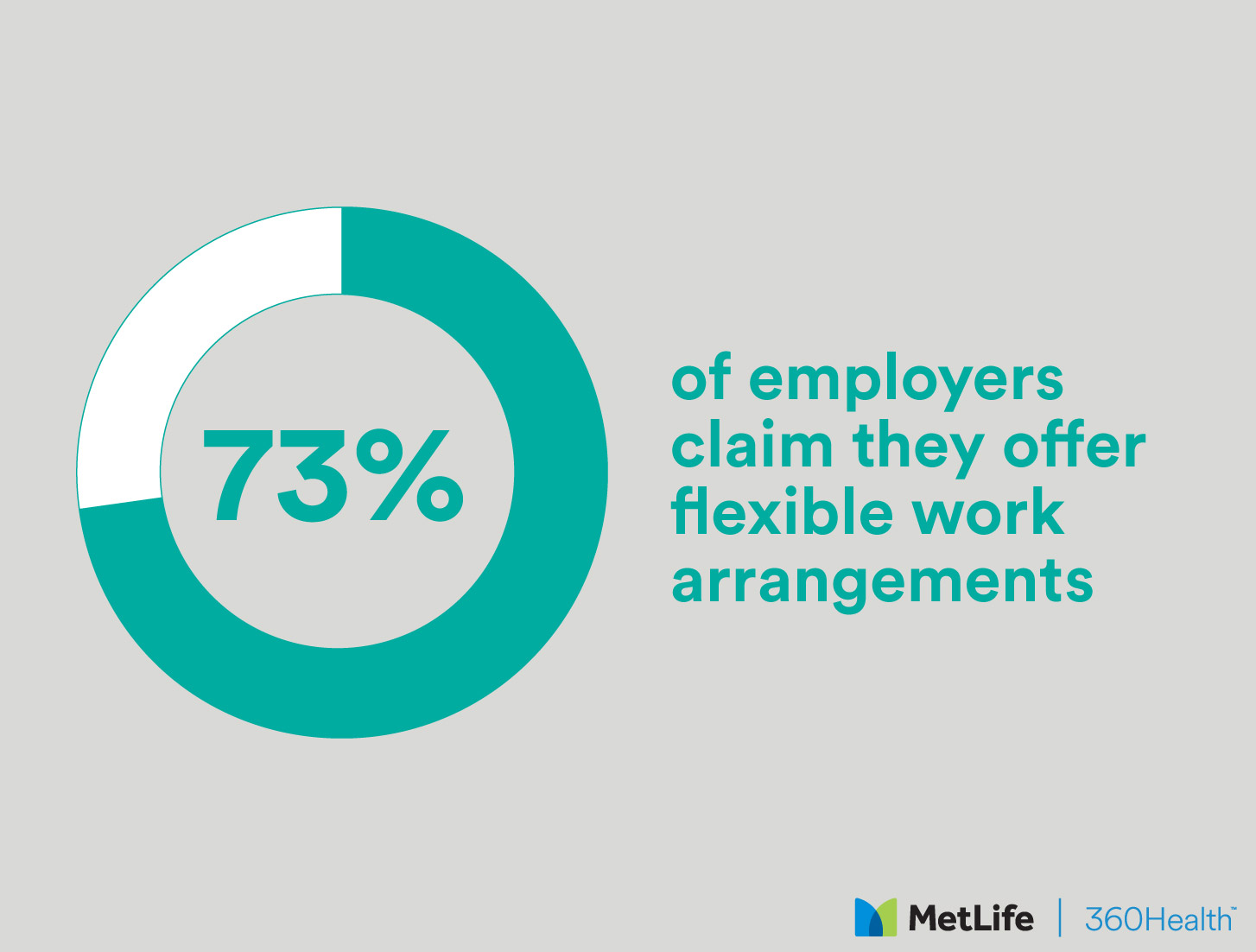

02-02-2021 The MetLife Australia 2020 Employee Benefits Trends Study has uncovered a disconnect over the meaning of ‘flexibility’, with a call for employers to empower employees when establishing work arrangements. READ MOREAustralians seeking financial guidance

04-06-2020 MetLife’s second phase of COVID-19 Insights research reveals spike in interest in insurance and superannuation as personal finance concerns continue. READ MORECOVID-19 Research Summary

20-04-2020 COVID-19 is taking a toll on people’s financial and mental wellbeing. The impact and uncertainty of COVID-19 is causing significant stress and anxiety (work and home life), with almost 60% of people claiming that COVID-19 has already directly impacted their financial position, and many saying that their mental health will take a significant hit. READ MOREFinancial wellness matters

27-08-2019 Financial Wellness is the state of being in strong financial health so that an individual can successfully manage day-to-day finances, protect against unplanned expenses and financial shocks, and plan and save for the future. READ MORE