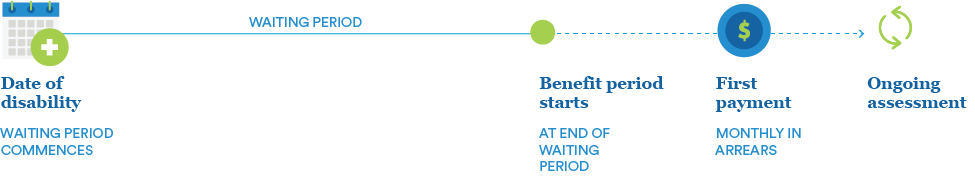

Your Case Manager (or your super fund, broker or adviser) will stay in contact throughout the assessment process and notify you of the outcome of your claim.

There are many regulations governing claims and the release of benefits through your super which require us to collect comprehensive information, including medical evidence, which can be a lengthy process. Typically, the more information you can provide early in the process, the easier it will be for us to help you.

When we have all of the information we need to make a decision, we’ll advise you and/or your super fund, broker or adviser of the decision within 15 working days and explain the reasons for our decision.

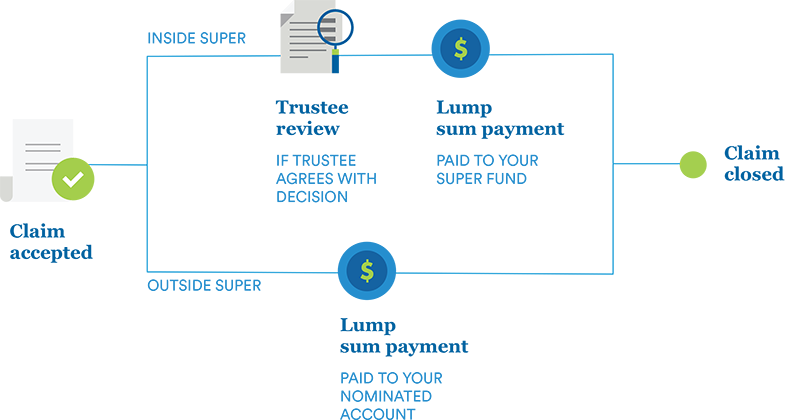

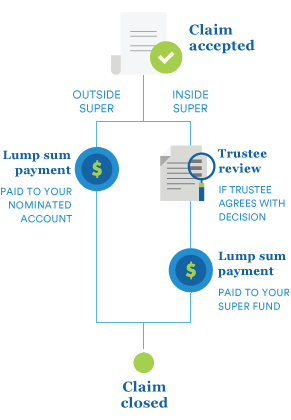

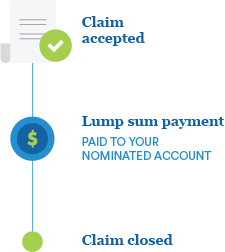

If you hold your insurance through super, we will communicate our decision to your fund trustee. By law, your fund trustee needs to review our assessment of your claim to ensure all claim decisions are fair and reasonable.

If there’s a delay in assessing your claim, or, we’re unable to accept your claim, we’ll explain why so you can provide additional information, make a complaint or appeal the decision.