Trauma Insurance (sometimes called Critical Illness Insurance) provides a one-off, lump sum payment if one of the many insured trauma events were to happen to you, such as being diagnosed with advanced cancer, or having a major heart attack or stroke.

Trauma Cover

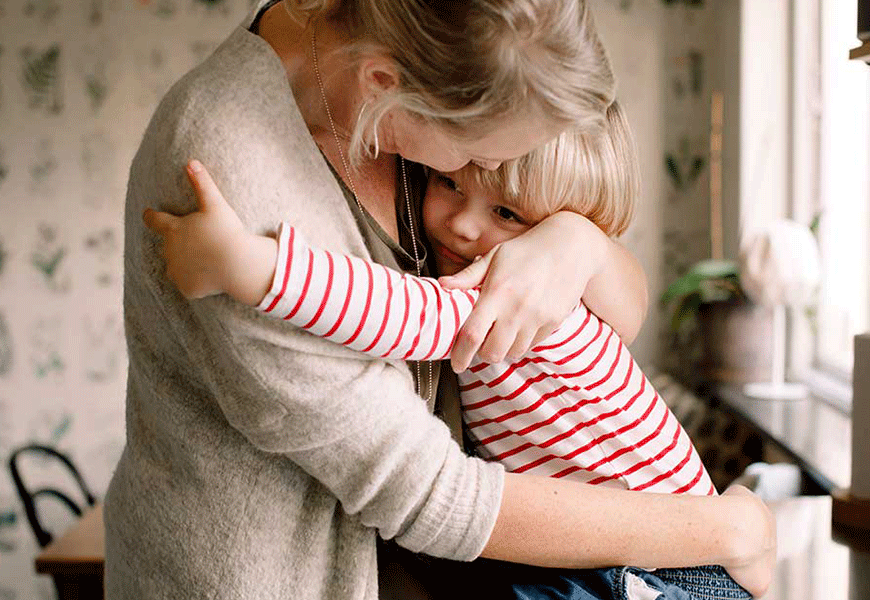

A serious illness puts stress on your mental and emotional well being. It can be financially devastating for you and your family, even after your recovery. It makes sense to cover yourself if illness means you can’t work for some time.

Flexible Cover Options

Choose the level of cover based on your financial needs, and increase or decrease it at any time.

One-off payment

Lump sum payment that you can use to cover things like out of pocket medical expenses and regular living costs.

Broad range of health events

Cover for many trauma events such as being diagnosed with advanced cancer, major heart attack or stroke.

Financial protection

Helpful if you don’t have other financial protection like Income Protection, Life Insurance and Health Insurance.

How it works

You’ll receive a lump sum payment that you can use to cover things like out of pocket medical expenses and regular living costs.

This means you can focus on getting well, without worrying about how you’re going to get by once you recover.

Trauma Insurance can be particularly helpful if you don’t have other forms of financial assets and protection such as Income Protection Insurance, Life Insurance, Private Health Insurance and Employee Benefits. You work out how much you’ll need, based on you and your family’s cost of living and any debts you have.

Support and peace of mind for people facing the consequences of death and terminal illness.

Total and Permanent Disability Insurance

Provides protection if you’re permanently unable to work due to injury or illness.

Trauma Insurance

Ensures you are protected if you suffer from a specified serious illness (such as cancer) or a specified serious injury, such as losing a limb.

Keep your life on track with a regular benefit if you are temporarily unable to work due to an illness or injury.

Claims Philosophy

Insurance is a promise we mean to keep – and a claim is our moment of truth. With over $485 million in claims paid last year, you can count on MetLife to be there when you need us most, along with a Claims decision within 10 days of getting your information.

What is Underwriting?

Underwriting can make all the difference when individual circumstances need to be factored in. That’s why we employ a dedicated and experienced local underwriting team to find the very best solution for your insurance.

Insurance Calculator

Our calculator is designed to provide you with an estimate of how much insurance protection cover you may need in the event of a trauma, death, total and permanent disability (TPD) or if you are unable to work. Plus it’s simple and easy to use.